Squadcash

Group Savings

Self-initiated

August - September 2021

Esusu as it is called by Yorubas, is a very common practice among Nigerian adults, it is called different things by different tribes. By the Igbos it is called Etoto, by the Hausas it is called Adashi. Whatever the name, the general concept remains the same.A group of people come together and make equal contributions and at the end of every period, one person takes it all and that is done rotationally, till everyone has had a chance to “collect” This project digitized this process to help younger audiences build better saving habits

My Role

User Research, User Flow, Personas, Wireframing, High Fidelity and Prototyping

The Challenge

Although young people 15 - 34 years old makeup 49% the employment population, the portion of people within this age group with an RSA is a measly 9.5%, also the current Gross Domestic Savings of the country is 21.65% with a GDP of 432.3 billion USD the average is 93.5 billion USD yearly and about 7.8 billion USD monthly. In a country with a workforce of about 63 million people, it can be assumed, that the average person has an average of 125 USD savings a month, which unfortunately is not the case because of various reasons, such as; the uneven distribution of wealth, gender pay gap, black tax, the need to grease various palms, and other emergencies caused by poor infrastructure like bad roads or insecurity to name a few.

Some and in most cases, all of these factors come together to drastically reduce a person’s ability to save on their own,for whatever reason,be it investments or acquiring necessities.

Older generations found a way around this with a form of informal financing where a group comes together, and make contributions of equal amounts at the same time during a fixed period and at the end of each period, the members take turns in collecting the total sum contributed.

Here’s an example: James, John, Jane and Joe want to save together, they agree to contribute 500 USD each week, at the end of each week, they have 2000 USD and after each week, every member takes turns collecting 2000 USD to use however they want.

This method has proven beneficial over the years because it helps people reach their financial goals quicker and some popular uses of these particularly in Nigeria are paying children’s fees, acquiring assets like land, holding on to it in case of an emergency,

However this wasn’t very common with the younger population, then came the challenge to digitize the process

References

Competitive Analysis

This is a summarized version of the analysis carried out on the top three competitors for a potential solution to this problem. The analysis indicated that the direct competitors did not have a lot of visibility and as a result, had a smaller userbase when compared to other indirect competitors who are industry leaders. This analysis also provided insight into the direction to gear the other aspects of research

Research Analysis

I conducted an online survey for a quantitative analysis and to serve as a screener for participants of the user interviews.

There were 65 participants in total, and 95.3% were between the ages 15 - 30, about half of these admit to earning money, all 65 participants have a bank account and 93.8% of all participants use a mobile banking service with the most popular ones being mobile applications and USSD. About 85% of participants stated that they have a practise of saving and 50.8% of those people save monthly and the most common saving method was leaving it in a bank account. When asked if mobile banking influenced saving habits and capabilities, positive and negative influences were highlighted by various participants.

Personas

After conducting the user research and interviews, the data was analysed and I was able to put this into three personas who were an overall representation of the selected target audience. The analysis included a deduction of pain-points, pleasures and capabilities.

How Might We?

Information Architecture

After the problem was clearly defined, an information architecture was designed to provide a sense of structure and help developers and other designers understand the interaction between pages and function. In order to create hierarchy across pages.

Wireframes

After conducting the user research and interviews, the data was analysed and I was able to put this into three personas who were an overall representation of the selected target audience. The analysis included a deduction of pain-points, pleasures and capabilities. The wireframes were iterated on multiple times, in order to explore multiple solutions.

First Design Iteration

The first design iteration had a number of usability and accessibility issues which were pointed out by the participants of an unmoderated usability test carried out by users. The insights of the sessions confirmed the "Aesthetic Usability Effect", as well as "Jakobs Law". It also revealed a number of missing steps in the flow.

These findings then guided the redesign, and restructuring of the project.

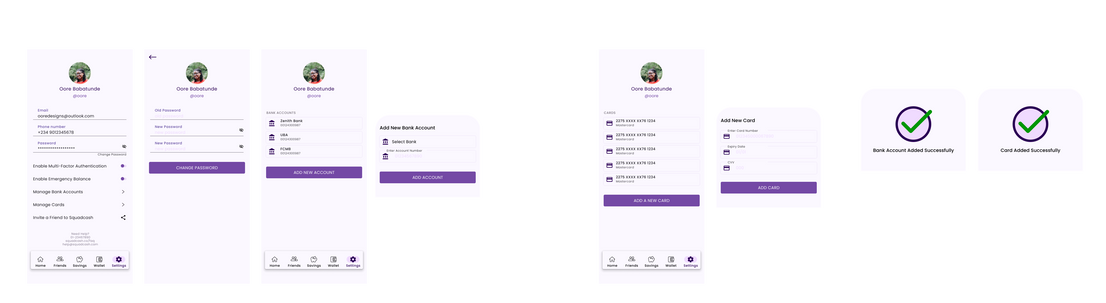

Current High-Fidelity Design

After multiple iterations, the wireframes were developed into high fidelity designs using accessible colours, easy to read and understand texts as well as content that aligned with the web content accessibility guidelines. You can scroll through the carousel below to have a look at the updated interface designs.

Prototypes

Dark Mode

Light Mode

Usability Test Summary

The prototype was tested with 5 participants who were asked to complete four tasks and give a usability score at the end of it. The table below contains a summary of the test results.

Conclusion

Although this project was self-initiated, I tried to be as thorough as possible. One of the challenges I experienced were participant recruitment for the quantitative survey. I solved this, by sharing not just with friends and family but by sharing with people on social media or asking people during intercept interviews if they'd be willing to take a minute to fill the survey.

While I understand that not all possible solutions were implemented, such as budgeting. I believe this project has a lot of potential and can be built upon and can help people improve their saving abilities